2026 COLA Impact: Understanding Your Benefits Starting January

The 2026 COLA impact is set to redefine financial landscapes for beneficiaries, with significant cost-of-living adjustments affecting Social Security, VA benefits, and more, commencing January. Understanding these changes is crucial for effective financial planning.

As we approach the new year, many individuals in the United States are keenly anticipating how the upcoming 2026 COLA impact will reshape their financial outlook. Cost-of-Living Adjustments, or COLAs, are designed to ensure that the purchasing power of Social Security and other federal benefits keeps pace with inflation, directly influencing the daily lives of millions of Americans. What exactly can beneficiaries expect when these adjustments take effect starting January?

Understanding the Basics of COLA and Its Purpose

The Cost-of-Living Adjustment (COLA) is a critical component of federal benefit programs, primarily Social Security and Supplemental Security Income (SSI). Its fundamental purpose is to protect beneficiaries from the erosion of purchasing power due to inflation. Without regular adjustments, the fixed income of retirees, disabled individuals, and survivors would steadily lose value over time, making it increasingly difficult to meet basic living expenses.

COLAs are typically announced in October of each year, based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter. This index measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The calculation method ensures that the adjustment reflects real-world changes in living costs, providing a vital financial buffer for those who rely on these benefits.

How COLA is Calculated

The Social Security Administration (SSA) uses a specific formula to determine the annual COLA. This involves comparing the average CPI-W for the third quarter of the current year with the average CPI-W for the third quarter of the last year in which a COLA was payable. The percentage increase, if any, is then applied to benefits.

- CPI-W Data: The primary economic indicator used for COLA calculations.

- Third Quarter Comparison: Data from July, August, and September is crucial.

- No Decrease Clause: Benefits can only increase or stay the same; they never decrease due to COLA.

Understanding this mechanism is essential for beneficiaries to anticipate potential changes and plan accordingly. The 2026 COLA impact will be a direct reflection of economic conditions leading up to its announcement, particularly inflation rates in the preceding months.

In essence, COLA serves as a safeguard, ensuring that the financial support provided by federal benefits remains relevant and sufficient in an ever-changing economic landscape. Its existence underscores a commitment to maintaining the dignity and financial stability of vulnerable populations.

Projected Economic Landscape Influencing the 2026 COLA

Forecasting the exact 2026 COLA impact requires a keen understanding of the economic indicators and trends expected to prevail in the coming months. While the official announcement is still some time away, economists and financial analysts are already making projections based on current inflationary pressures, wage growth, and global economic stability. These factors collectively paint a picture of what beneficiaries might expect.

Inflation, particularly in essential sectors like housing, food, and energy, remains a dominant force. Persistent high prices often necessitate a more substantial COLA to compensate for the increased cost of living. Conversely, a moderation in inflation could lead to a more modest adjustment. The Federal Reserve’s monetary policy, specifically interest rate decisions, also plays a significant role in shaping the inflationary environment.

Key Economic Factors at Play

Several variables will heavily influence the 2026 COLA. Monitoring these can provide early insights into the potential adjustment:

- Inflation Rates: The most direct driver, especially as measured by the CPI-W.

- Energy Prices: Volatility in oil and gas markets can quickly impact overall inflation.

- Supply Chain Dynamics: Ongoing disruptions or improvements affect the cost of goods.

- Wage Growth: Strong wage growth can sometimes signal broader inflationary pressures.

Experts are currently analyzing various scenarios, from continued elevated inflation to a gradual return to more stable price levels. The trajectory of the global economy, including geopolitical events and trade relationships, will also factor into the domestic economic situation, ultimately influencing the 2026 COLA calculation.

Ultimately, the 2026 COLA will be a reflection of how effectively the economy manages to balance growth with price stability. Beneficiaries should stay informed about these macroeconomic trends, as they directly correlate with the size of their upcoming benefit adjustments.

How the 2026 COLA Impact Will Affect Social Security Benefits

The most significant and widely discussed aspect of any COLA is its effect on Social Security benefits. Millions of retirees, survivors, and individuals with disabilities rely on these payments as a primary source of income. The 2026 COLA impact will directly determine the increase in their monthly payments, influencing their budgeting and overall financial security.

A higher COLA means a larger monthly check, which can be crucial for covering rising expenses. For many, even a small percentage increase can make a substantial difference in their ability to afford necessities like groceries, utilities, and healthcare. Conversely, a lower COLA, or even no COLA, can put financial strain on beneficiaries if inflation continues to rise.

It’s important to remember that the COLA adjusts the primary insurance amount (PIA), which is the benefit a person would receive if they elect to begin receiving retirement benefits at their full retirement age. All other benefit types, such as spousal benefits or survivor benefits, are based on a percentage of the PIA, meaning they will also see a corresponding increase.

Potential Scenarios for Social Security Recipients

Depending on the final COLA percentage, various outcomes are possible for Social Security recipients:

- Strong COLA: Provides significant relief against inflation, improving purchasing power.

- Moderate COLA: Helps maintain purchasing power but might not fully offset all rising costs.

- Low or Zero COLA: Could lead to a real decrease in purchasing power if inflation persists.

Beneficiaries should also consider how the COLA might interact with other aspects of their financial planning, such as income taxes. While the COLA increases benefits, it could potentially push some individuals into a higher tax bracket or increase the amount of their Social Security benefits subject to taxation, depending on their overall income.

In summary, the 2026 COLA will be a pivotal factor for Social Security recipients, directly influencing their financial stability and ability to manage daily expenses. Staying informed about the projected COLA and planning for its effects is a proactive step toward financial well-being.

Impact on Other Federal Benefits and Programs

While Social Security benefits are often the primary focus, the 2026 COLA impact extends far beyond, influencing a wide array of other federal benefits and programs. These adjustments are crucial for ensuring that various forms of financial assistance maintain their real value and continue to provide adequate support to beneficiaries.

Supplemental Security Income (SSI) is another major program directly affected by the COLA. SSI provides financial assistance to low-income individuals who are aged, blind, or disabled, and its adjustments are tied to the same COLA as Social Security. An increase in SSI payments helps these vulnerable populations cope with rising costs of living.

Benefits Subject to COLA Adjustments

Beyond Social Security and SSI, several other federal programs typically see adjustments in line with the COLA:

- Veterans’ Benefits: Disability compensation, pension, and other benefits for veterans are usually increased.

- Federal Civil Service Retirement System (CSRS) and Federal Employees Retirement System (FERS) Annuities: Retirees from federal service also receive COLA adjustments to their pensions.

- Railroad Retirement Benefits: Similar to Social Security, these benefits are adjusted to combat inflation.

The ripple effect of the 2026 COLA can also indirectly impact other programs that use federal benefit levels as a reference point for eligibility or aid calculations. For instance, an increase in Social Security or SSI could alter eligibility thresholds for certain state-level assistance programs, though these interactions are more complex and vary by state.

It is important for beneficiaries of these diverse federal programs to understand how the upcoming COLA will specifically affect their individual payments. Accessing official government resources and consulting with financial advisors specializing in federal benefits can provide personalized insights and guidance.

In conclusion, the 2026 COLA is a comprehensive adjustment that aims to preserve the purchasing power across a broad spectrum of federal benefits, providing essential financial stability to millions of Americans.

Preparing for the 2026 COLA: Financial Planning Strategies

Understanding the potential 2026 COLA impact is the first step; the next is to integrate this knowledge into effective financial planning. Regardless of whether the COLA is robust or modest, proactive strategies can help beneficiaries maximize their financial well-being and navigate any changes effectively. Sound financial planning is about adapting to new realities and making informed decisions.

One crucial strategy is to review your current budget. With an anticipated increase in benefits, even if slight, it’s an opportune moment to reassess income versus expenses. Identify areas where you can optimize spending or allocate additional funds to savings or debt reduction. This review should be ongoing, not just a one-time event.

Key Financial Planning Tips

- Re-evaluate Your Budget: Adjust spending and saving plans in light of new benefit amounts.

- Monitor Inflation: Stay aware of rising costs in essential categories like food, healthcare, and housing.

- Consider Tax Implications: Understand how increased benefits might affect your tax liability.

- Consult a Financial Advisor: Seek professional guidance tailored to your specific situation.

Another important consideration is the potential for increased healthcare costs. Even with a COLA, Medicare Part D premiums and other out-of-pocket medical expenses can rise, potentially offsetting some of the benefit increase. Planning for these costs is vital, perhaps by exploring supplemental insurance options or health savings accounts if eligible.

Finally, don’t underestimate the power of saving, even small amounts. Any additional funds from a COLA increase, if not immediately needed for essential expenses, can be directed towards an emergency fund or long-term savings goals. This builds a stronger financial safety net for future uncertainties.

By adopting these proactive financial planning strategies, beneficiaries can effectively prepare for the 2026 COLA impact, ensuring their financial stability and peace of mind.

Historical Context and Future Projections of COLA

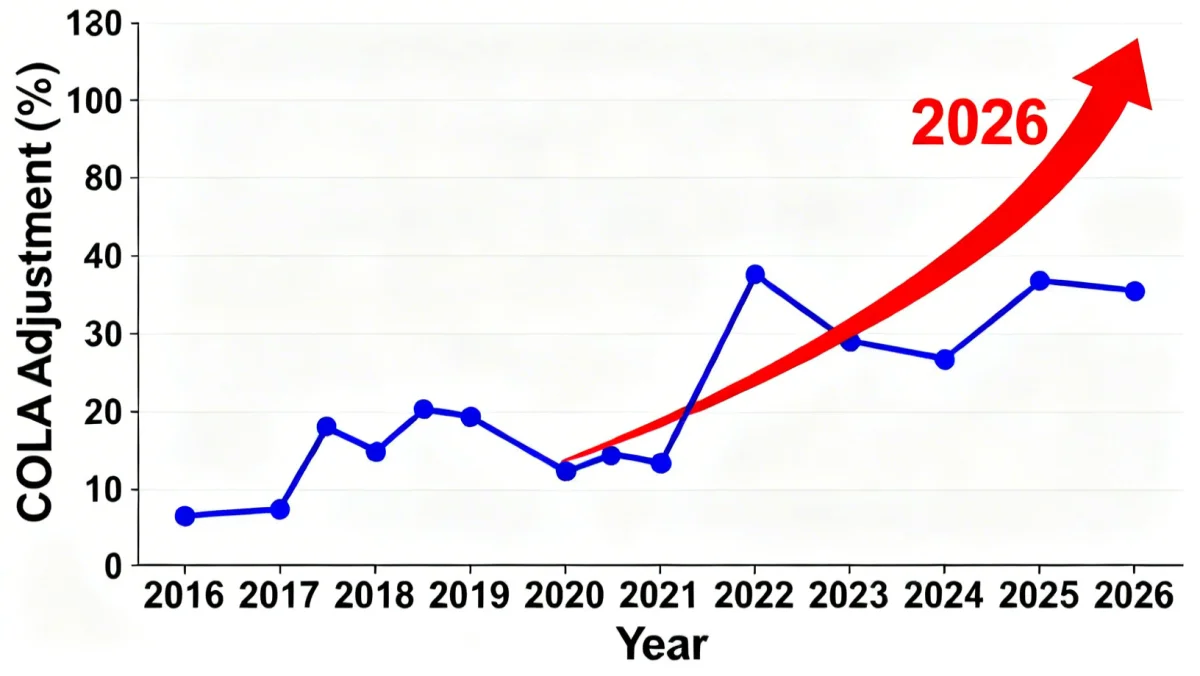

To fully appreciate the significance of the 2026 COLA impact, it’s beneficial to look at its historical context and consider future projections. COLA adjustments have varied significantly over the decades, reflecting different economic eras. Understanding these past trends can offer insights into what might lie ahead, though past performance is not indicative of future results.

In periods of high inflation, COLAs have been substantial, providing necessary relief to beneficiaries. Conversely, during times of low inflation or deflation, COLAs have been minimal or even non-existent. The highest COLA on record was 14.3% in 1980, a response to rampant inflation. More recently, adjustments have been more modest, with some years seeing very small or zero increases.

Analyzing Past COLA Trends

Examining historical data reveals patterns and highlights the responsiveness of COLA to economic conditions:

- High Inflation Periods: Typically result in larger COLA increases.

- Economic Stagnation: Can lead to lower or no COLA adjustments.

- CPI-W’s Role: Demonstrates the direct link between consumer prices and benefit adjustments.

Looking forward, the future of COLA is inextricably linked to the broader economic trajectory of the United States and the global economy. Factors such as technological advancements, demographic shifts, and evolving monetary policies will all shape the inflationary environment and, consequently, future COLA determinations. There’s ongoing debate among policymakers and economists about the adequacy of the current CPI-W measure for retirees, with some advocating for an alternative index, such as the CPI-E (Consumer Price Index for the Elderly), which might better reflect the spending patterns of seniors.

While the exact future is unpredictable, it’s clear that COLAs will continue to be a vital mechanism for adjusting federal benefits. Beneficiaries should remain engaged with economic news and policy discussions surrounding these adjustments, as they directly impact their financial futures.

Advocacy and Policy Discussions Surrounding COLA

The 2026 COLA impact, and COLAs in general, are not merely economic calculations; they are also subjects of ongoing advocacy and policy discussions. Various organizations and lawmakers frequently debate the adequacy of the current COLA formula, its impact on different beneficiary groups, and potential reforms to ensure its effectiveness in the long term. These discussions highlight the political and social dimensions of benefit adjustments.

One of the most persistent discussions revolves around the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as the basis for COLA. Critics argue that the CPI-W does not accurately reflect the spending patterns of seniors, who typically spend more on healthcare and housing than the general urban wage earner population. They advocate for the adoption of the Consumer Price Index for the Elderly (CPI-E) instead, which tends to show higher inflation rates for this demographic.

Key Areas of Policy Debate

- CPI-W vs. CPI-E: The debate over which inflation index best serves beneficiaries.

- Medicare Premium Impact: Discussions on how COLA affects Part B premiums and the ‘hold harmless’ provision.

- Long-term Adequacy: Ensuring COLAs provide sufficient protection against inflation over decades.

Another area of concern is the ‘hold harmless’ provision, which prevents Medicare Part B premiums from increasing by more than the dollar amount of a beneficiary’s Social Security COLA. While this protects many, it can lead to higher premium increases for those not covered by the provision, or for beneficiaries with very low COLAs. Policy discussions often explore ways to mitigate these effects and ensure fairness across all beneficiaries.

Advocacy groups for seniors and other beneficiaries play a crucial role in bringing these issues to the forefront. They lobby Congress, conduct research, and raise public awareness about the importance of robust and equitable COLA adjustments. Their efforts often influence legislative proposals and public opinion, shaping the future direction of federal benefit policies.

In conclusion, the discourse surrounding COLA is dynamic and complex, reflecting a broader commitment to ensuring the financial security of millions. The outcomes of these policy discussions could significantly alter how the 2026 COLA and future adjustments are determined and implemented.

| Key Point | Brief Description |

|---|---|

| COLA Purpose | Adjusts federal benefits to counter inflation, preserving purchasing power. |

| 2026 COLA Drivers | Influenced by inflation, energy prices, and supply chain dynamics. |

| Social Security Impact | Directly increases monthly payments for millions of beneficiaries. |

| Financial Planning | Review budgets, monitor inflation, and consider tax implications. |

Frequently Asked Questions About the 2026 COLA

The primary purpose of the Cost-of-Living Adjustment (COLA) is to protect the purchasing power of federal benefits, such as Social Security, by adjusting them annually to keep pace with inflation. This ensures that beneficiaries’ income maintains its value over time against rising costs.

The 2026 COLA is typically announced by the Social Security Administration in October of the preceding year. This announcement is based on inflation data from the third quarter (July, August, and September) of that year, allowing beneficiaries to prepare for the changes starting January.

Yes, Medicare Part B premiums can be affected. The ‘hold harmless’ provision generally prevents premiums from increasing more than your Social Security COLA in dollar terms. However, this does not apply to all beneficiaries, and some may see higher premium increases.

The 2026 COLA will be primarily influenced by inflation rates, particularly as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Other factors include energy prices, supply chain stability, and overall wage growth in the economy.

Many federal benefits, including Social Security and Supplemental Security Income (SSI), are adjusted by the same COLA. Other benefits, such as those for veterans and federal retirees, also typically receive COLA adjustments, though specific calculations might vary slightly.

Conclusion

The 2026 COLA impact stands as a critical financial event for millions of Americans who rely on federal benefits. These cost-of-living adjustments, set to take effect in January, are designed to safeguard purchasing power against inflation, reflecting the dynamic economic landscape. By understanding the calculation methods, anticipating economic trends, and proactively engaging in financial planning, beneficiaries can better prepare for the changes ahead. Staying informed about policy discussions and advocacy efforts surrounding COLA will also empower individuals to navigate their financial futures with greater confidence and stability, ensuring that their benefits continue to provide essential support in a changing world.